ENERGIZER HOLDINGS (ENR)·Q1 2026 Earnings Summary

Energizer Beats on Revenue and EPS But Warns on Margin Headwinds

February 5, 2026 · by Fintool AI Agent

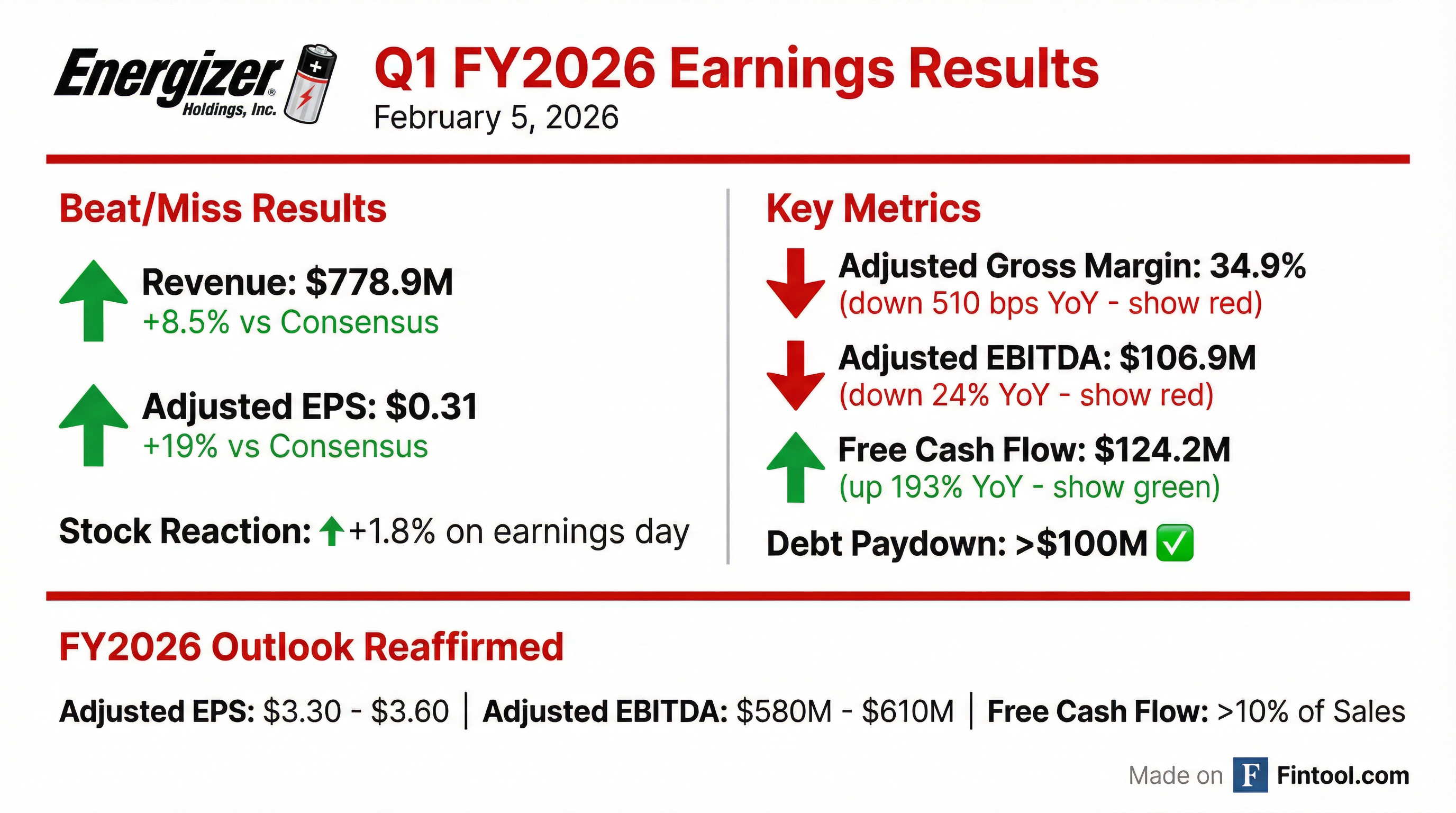

Energizer Holdings (NYSE: ENR) reported Q1 FY2026 earnings that topped Wall Street estimates on both the top and bottom lines, but revealed significant margin pressure from tariffs and integration costs. Despite delivering $778.9M in revenue (+8.5% vs consensus) and adjusted EPS of $0.31 (+19% vs estimates), adjusted gross margin contracted 510 basis points year-over-year to 34.9%. The stock rose 1.8% following the release as investors focused on the beats and strong free cash flow generation.

Did Energizer Beat Earnings?

Yes — Energizer delivered a double beat on Q1 FY2026 results:

*Values retrieved from S&P Global

However, year-over-year performance was notably weaker:

The stark contrast between the consensus beat and YoY declines reflects elevated transitional costs related to tariffs and the Advanced Power Solutions (APS) acquisition integration that management expects to normalize.

What Drove the Revenue Beat?

Revenue growth of 6.5% on a reported basis was powered by the APS acquisition contribution, while organic revenue declined 4.3%:

Batteries & Lights Segment (+8.3% reported, -3.8% organic):

- APS acquisition contributed +10.2%

- Currency tailwind of +1.9%

- Organic decline reflects tough storm-related comparisons from prior year

Auto Care Segment (-5.6% reported, -6.9% organic):

- Continued consumer softness in discretionary auto care spending

- Currency provided modest +1.4% tailwind

Back Half Growth Drivers

Management outlined specific growth catalysts for H2:

The APS brand transition—converting customers from Panasonic-branded to Energizer-branded batteries—is "expected to contribute over $30 million of organic growth in the year, most of it landing in the third and fourth quarters."

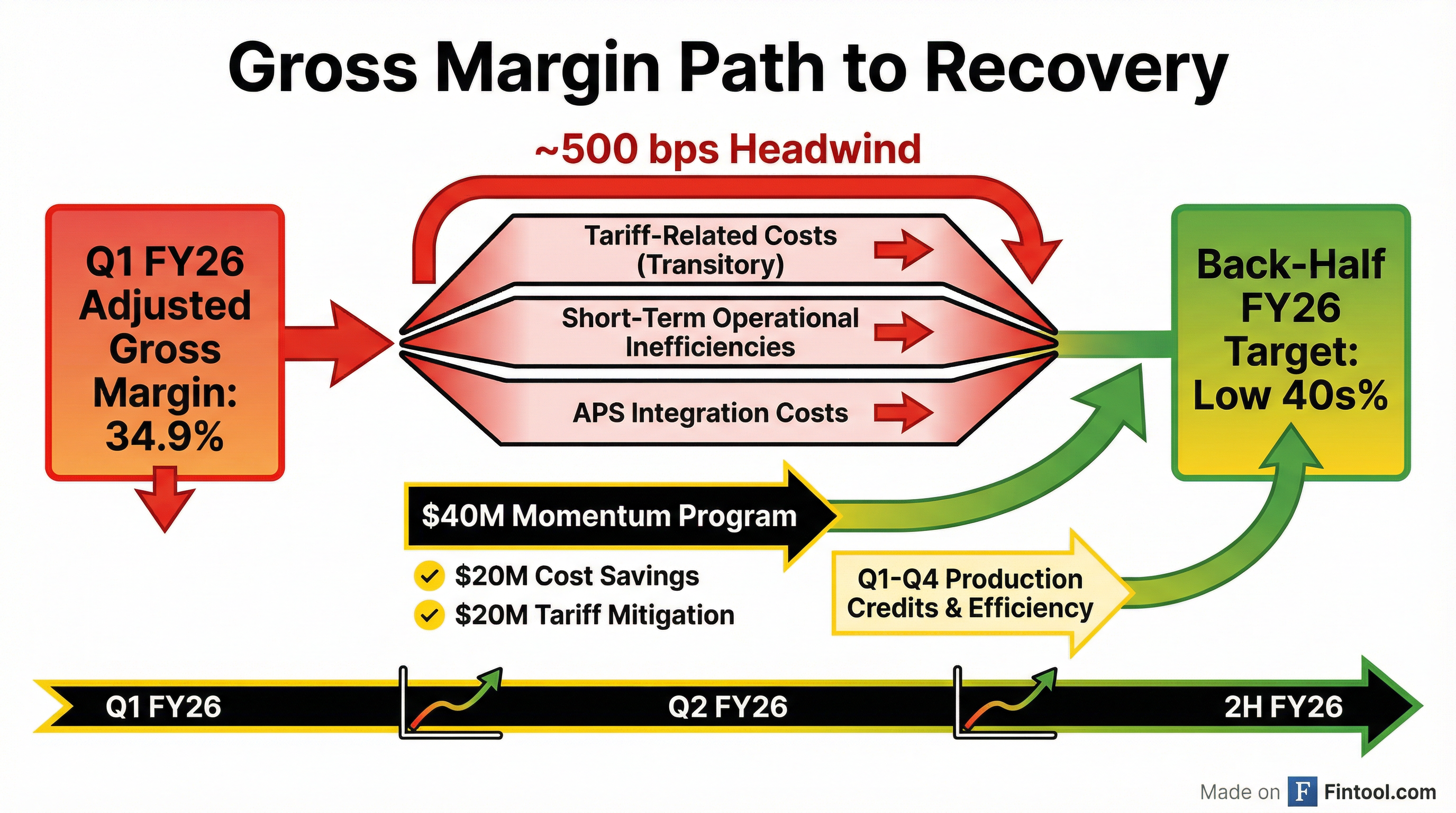

Why Did Gross Margin Collapse?

The 510 bps gross margin decline to 34.9% was the quarter's biggest headline challenge. Management provided granular detail on the Q1 drivers in the earnings call:

The company sold $65M of Panasonic-branded product in Q1 to transition APS customers, creating a one-time margin drag that won't recur.

Margin Recovery Roadmap

Management laid out a clear sequential path to margin normalization:

Key drivers of margin recovery include:

- Tariff normalization: Cycling through high-rate inventory bought in spring/summer 2025

- Supply chain realignment: Relocating production capacity, diversifying sourcing

- Production tax credits: Expected to drive ~50% benefit above prior year

- Targeted pricing: 50-100 bps benefit in back half

How Did the Stock React?

ENR shares rose 1.8% on earnings day, closing at $23.38 versus the prior close of $22.96. The positive reaction suggests investors looked through the margin headwinds and focused on:

- The revenue and EPS beats versus lowered expectations

- Strong free cash flow generation ($124.2M, or 15.9% of sales)

- Reaffirmed full-year guidance

The stock remains well off its 52-week high of $32.86, trading near the lower end of its range after a challenging 2025.

What Did Management Guide?

Full-Year FY2026 Outlook — Reaffirmed

Q2 FY2026 Outlook

Notably, the Q2 outlook does not contemplate any impact from recent winter storm activity.

Capital Allocation: Deleveraging in Focus

Strong cash generation enabled meaningful capital deployment in Q1:

Leverage Target: Management expects to reach 5x or slightly below by year-end, continuing to prioritize debt paydown which "directly shifts value to equity holders."

M&A Stance: The company remains open to M&A but any deals would be "leverage neutral" and "on the smaller side" to avoid disrupting the deleveraging trajectory.

Q&A Highlights: What Management Said

On Category Recovery and Winter Storms

"The category certainly improved in December... we also have gained share in the latest reporting periods. The category is improving, and we're improving slightly ahead of the category."

The January winter storms drove a 50%+ surge in one-week category value, though management noted it's "too early to quantify" the full impact on Energizer's business. Q2 guidance does not include storm benefits.

On Private Label Competition

"Private label plays a role in the category... We did see an increase in private label at certain retailers, as well as some aggressive pricing. This results in volume growth for those retailers, but actually erodes category value at the same time."

Management noted some retailers have already "recalibrated their approach" to restore balance between private label and branded products.

On Consumer Bifurcation

Auto care is seeing a bifurcated consumer: higher-end products growing while middle/lower-end consumers are "delaying purchases or opting out altogether." This makes the Armor All Podium Series launch "all the more timely" as Energizer participates in premium growth.

On Input Costs and Hedging

"On zinc, we're over 90% fixed for 2026... trends are slightly negative. I don't expect it to be a huge impact in 2026, but it's something that we've got to continue to manage."

Zinc, lithium, silver, and R-134a refrigerant all showed negative price movements, but hedges and inventory provide near-term protection.

What Changed From Last Quarter?

The biggest shift is the severity of margin pressure from tariffs, which wasn't fully visible last quarter. However, management has also provided a clearer roadmap to recovery.

Strategic Priorities

Energizer outlined four fiscal 2026 priorities:

- Restore organic net sales growth through strengthened distribution and advancing innovation

- Rebuild gross margins impacted by tariffs

- Return to historical free cash flow profile

- Disciplined capital deployment to maximize shareholder value

Innovation highlights include the expansion of plastic-free packaging (eliminating over 2 million pounds of plastic waste) and leadership in the specialty battery segment, which has grown 25% over 4 years.

Risks and Concerns

Tariff Uncertainty: Full-year tariff impact expected at $60M-$70M. While ~300 bps Q1 impact should improve, policy uncertainty remains.

Consumer Weakness: Auto Care faces a bifurcated consumer with lower-end buyers delaying or opting out of purchases.

Input Cost Inflation: Zinc, lithium, silver, and R-134a showing negative price trends. While 90%+ hedged for 2026, management noted "we'll continue to see pressure as we go more into 2027."

Private Label Pressure: Some retailers aggressively pricing private label, eroding category value even as branded volumes hold.

Leverage: Net leverage at ~5x with total debt of ~$3.5B; active deleveraging underway.

Margin Recovery Execution: The path from 34.9% to low-40s gross margin requires successful execution across supply chain realignment, production credits, and pricing.

The Bottom Line

Energizer delivered a solid beat on lowered expectations, with revenue and EPS both exceeding consensus. The real story, however, is the 510 bps gross margin contraction that management attributes to transitional tariff and integration costs. The company has outlined a credible path to margin recovery by the back half of fiscal 2026 and reaffirmed full-year guidance.

Strong free cash flow of $124.2M (15.9% of sales) and $100M+ in debt paydown demonstrate financial discipline even amid margin pressure. For investors, the key question is whether management can execute on margin recovery while navigating ongoing tariff and consumer uncertainty.

All financial data from Energizer Q1 FY2026 earnings presentation dated February 5, 2026. Consensus estimates from S&P Global Capital IQ.